Insurance and Medication Changes: How to Navigate Formularies Without Gaps in Care

Formulary Cost Calculator

Understand Your Formulary Impact

This tool helps you see how a formulary change might affect your medication costs. Enter your current details to see potential costs with a new tier.

Current Medication Information

Potential Formulary Change

When your insurance plan changes the list of drugs it covers, it’s not just a paperwork update-it can mean paying three times more for your medication, waiting weeks for approval, or worse, running out of pills with no clear path forward. This happens to formulary changes more often than most people realize. In 2023, over 12% of Medicare beneficiaries saw at least one of their medications removed from their plan’s formulary. For many, it’s a silent crisis: no warning, no easy way to check, and no clear help when it hits.

What Is a Formulary, Really?

A formulary is simply the list of prescription drugs your insurance plan agrees to pay for. It’s not random. Every drug on that list has been reviewed by a team of doctors and pharmacists who decide which medications offer the best mix of safety, effectiveness, and cost. The goal? To keep your premiums low while still giving you access to the medicines you need. But here’s the catch: formularies change. Every year, on January 1, most plans update their lists. Some drugs get moved to higher tiers (meaning higher costs). Others get removed entirely. And if you’re taking one of those, you could suddenly face a $400 monthly bill instead of $45.How Formularies Are Built-And Why They Change

Most plans use a tier system. Think of it like a pricing ladder:- Tier 1: Generic drugs-usually $0 to $10 per prescription.

- Tier 2: Preferred brand-name drugs-$25 to $50.

- Tier 3: Non-preferred brands-$50 to $100.

- Tier 4/5: Specialty drugs-$100+, sometimes 30-50% of the total cost.

- A cheaper generic or brand alternative becomes available.

- A drug gets flagged for safety issues by the FDA.

- The pharmacy benefit manager (PBM)-the middleman handling your plan’s drug list-negotiates a better deal with a different manufacturer.

How to Find Your Formulary (Before It’s Too Late)

You can’t rely on your doctor or pharmacist to catch every change. Most don’t get real-time updates. You have to check yourself. Here’s how:- Find your exact plan name. Look at your insurance card. Write it down.

- Go to your insurer’s website. Don’t use Google. Go directly.

- Search for “formulary,” “drug list,” or “prescription coverage.” It’s usually buried under “Plan Materials” or “Member Resources.”

- Search for each medication you take. Check the tier and any restrictions-like prior authorization or step therapy.

What Happens When Your Drug Gets Removed

If your medication is taken off the formulary, you have options. But you need to act fast. First, don’t stop taking it. Contact your doctor immediately. They can file an exception request. The most common reasons exceptions get approved:- You tried the alternative and had side effects.

- You tried the alternative and it didn’t work.

- You’ve been on this drug for years and it’s stable.

Real Stories: The Good, the Bad, and the Ugly

One man in Florida lost his heart medication from Tier 2 to Tier 4 overnight. His copay jumped from $45 to $450. He spent three weeks and seven phone calls getting an exception approved. Another woman with diabetes had her med removed. Her doctor filed an exception. It was approved in 48 hours-with no cost increase. A 72-year-old cancer patient in Ohio faced a 21-day gap when her specialty drug was dropped without notice. She had to delay treatment. Her oncologist called it “unacceptable.” The difference? Preparation. The woman who got approved fast had checked her formulary during Open Enrollment. The cancer patient didn’t.What’s Changing in 2025 and Beyond

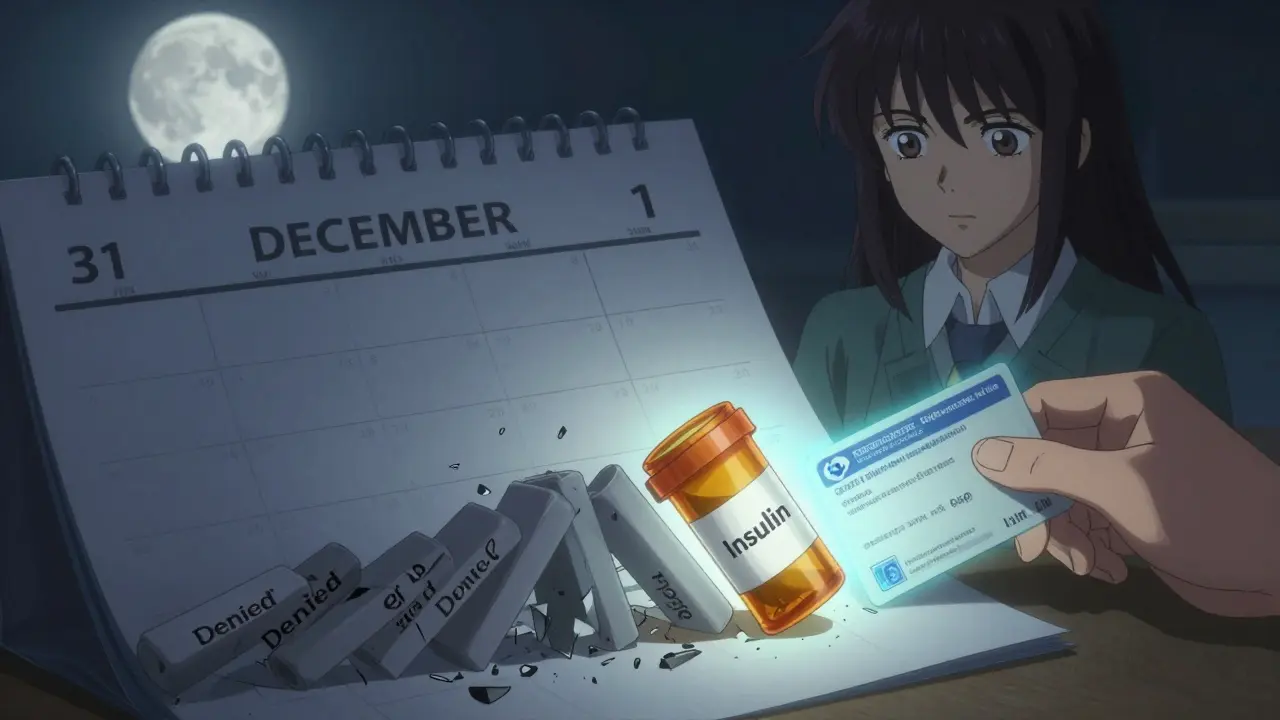

The Inflation Reduction Act is reshaping formularies. Starting in 2025, Medicare Part D will cap out-of-pocket drug costs at $2,000 a year. That means fewer restrictions on high-cost meds. Also in 2025:- Insulin will cost no more than $35 per month-no matter your plan.

- More drugs will be subject to Medicare price negotiations, which could lead to formulary shifts.

- AI-driven formulary tools are being used by 37% of PBMs. They predict which drugs will be most cost-effective based on real-world data.

How to Stay Protected

Follow this simple checklist every year:- Make a list of all your prescriptions-including doses and why you take them.

- Check your formulary between October 15 and December 7.

- Call your pharmacy and ask: “Is my medication still covered on my plan?”

- Ask your doctor: “If this drug is removed, what’s the next best option?”

- Set a calendar reminder for January 1. That’s when changes take effect.

When to Switch Plans

If your current plan removes a drug you rely on and denies your exception request, you can switch plans. But only during Open Enrollment (October 15-December 7) or during a Special Enrollment Period. Special Enrollment Periods happen if:- You move out of your plan’s service area.

- You lose other coverage (like Medicaid).

- You qualify for Extra Help (low-income subsidy).

Final Word: Knowledge Is Your Shield

Formularies aren’t designed to hurt you. But they’re not designed to protect you either. They’re tools for cost control-and if you don’t understand them, you’re the one paying the price. The people who get through formulary changes without disruption? They check their plans. They ask questions. They don’t assume anything. You don’t need to be a pharmacist. You don’t need to be a lawyer. You just need to take 30 minutes once a year-and keep that list handy.What happens if my insurance removes my medication from the formulary?

Your plan will usually notify you, but not always clearly. You can request an exception from your doctor, which may allow you to keep the drug at the same cost. If denied, you can switch to an alternative medication or change your insurance plan during Open Enrollment. Always check your formulary before January 1 to avoid surprises.

How often do formularies change?

Most formularies update once a year on January 1. But about 23% of plans make changes mid-year-often when a drug’s safety is questioned or a cheaper alternative becomes available. Always check your plan’s website regularly, especially if you’re on a chronic medication.

Can I get my drug back on the formulary?

Yes, through an exception request. Your doctor must submit documentation showing you’ve tried alternatives without success, or that you’ve had adverse reactions. Approval rates are high for life-saving drugs like cancer treatments (92%) but lower for skin or mental health meds (as low as 65%).

Why are some drugs not covered at all?

Drugs may be excluded if they’re considered experimental, have cheaper alternatives, or are deemed unsafe by the FDA. Some plans also exclude medications that aren’t FDA-approved for your specific condition. Always confirm your drug’s approved use matches your plan’s coverage rules.

Is there help if I can’t afford my medication after a formulary change?

Yes. Many drug manufacturers offer patient assistance programs. Medicare’s Extra Help program reduces costs for low-income beneficiaries. Nonprofits like NeedyMeds and the Patient Access Network Foundation also provide grants. Call your pharmacy-they often know about these programs.

Should I switch plans just because one drug was removed?

Not necessarily. Compare the full formulary-not just one drug. A plan that removes your medication might cover others you take at a lower cost. Use the Medicare Plan Finder or your insurer’s comparison tool to see total annual drug costs across all your prescriptions before switching.

Diana Campos Ortiz

Just checked my formulary yesterday-my diabetes med got moved to Tier 4. $380 a month now. I’m crying in the pharmacy aisle. This isn’t healthcare, it’s a hostage situation.

Adam Rivera

Man, I feel you. My mom’s on 7 meds and we had to call 5 different pharmacies just to find one that still stocked her old brand. Pharmacies don’t even know what’s covered half the time. Always check the insurer’s site directly-Google is useless.

Anny Kaettano

Formularies are a goddamn labyrinth built by PBMs who’ve never met a patient. Tier systems? More like tiered exploitation. They don’t care if you’ve been on a med for 12 years-what matters is the rebate they got from the new manufacturer. And don’t get me started on step therapy. ‘Try this cheaper junk first’-when your kidneys are failing? That’s not cost control, that’s cruelty wrapped in a clinical protocol.

But here’s the thing: you can fight it. Exception requests work. I got my neurologist to submit a 3-page letter with my lab results, prior authorization history, and a letter from my physical therapist. Approved in 48 hours. They don’t want to approve them-they just need you to make it inconvenient enough to skip.

And yes, Medicare’s $2k cap in 2025 is a start, but it doesn’t touch commercial plans. And PBMs still control 87% of the market. We need to break their monopolies. Call your rep. Write to CMS. This isn’t just about pills-it’s about dignity.

Jesse Ibarra

Oh wow, another ‘poor me’ post about drug costs. Let me guess-you also think insulin should be free and that people who can’t afford their meds just need to ‘try harder.’ Newsflash: insurance isn’t a charity. If you can’t afford your meds, maybe you shouldn’t have picked a plan with zero out-of-pocket protection. Stop blaming the system. Blame yourself for not reading the fine print.

laura Drever

lol formularies. who even cares. my dr just switches me every year anyway. its not like i have a choice. also why is everyone so dramatic. its just a pill.

Randall Little

Let me get this straight-you’re shocked that a for-profit system prioritizes profit? That’s like being surprised water is wet. The real tragedy? People still think this is ‘healthcare.’ It’s a financial instrument disguised as a lifeline. And the fact that 68% of Medicare beneficiaries can’t find their formulary? That’s not incompetence-that’s design. Make it hard. Make it confusing. Make people give up. Then they’ll take the cheaper junk. Classic PBM playbook.

Also, AI-driven formularies? That’s just algorithmic eugenics with a spreadsheet. If your drug doesn’t maximize ROI, it gets dropped. Doesn’t matter if it’s the only thing keeping you alive.

James Castner

It is imperative to recognize, from a systemic and ethical standpoint, that the current pharmaceutical access paradigm in the United States constitutes a structural violation of the principle of equitable health care delivery. The confluence of Pharmacy Benefit Manager monopolies, tiered formulary architectures, and the absence of federal mandates requiring transparent, patient-centered formulary disclosures has engendered a state of medical precarity that disproportionately impacts elderly, chronically ill, and economically vulnerable populations. The fact that 78% of exception requests are approved-when properly documented-demonstrates not a functional safety net, but a procedural loophole that requires significant patient advocacy, legal literacy, and clinical capital to navigate. One cannot reasonably expect a diabetic grandmother with limited digital literacy to parse a 120-page PDF formulary document on a mobile device while managing three chronic conditions. This is not a failure of individual responsibility-it is a failure of institutional accountability. The Inflation Reduction Act’s $2,000 cap is a symbolic gesture, but without caps on PBM rebates, without transparency in drug pricing, and without mandatory inclusion of all FDA-approved indications in formularies, we are merely rearranging deck chairs on the Titanic.

lucy cooke

Ugh. Another ‘I’m so oppressed by my insurance’ post. Can we please stop pretending this is unique to America? In the UK, we don’t even get to choose our meds half the time. You think your $450 copay is bad? Try getting a specialist appointment without a 6-month wait. At least here, you can fight it. Over here, you just… wait. And die. So maybe stop whining and be grateful you’re not in a socialist nightmare.

Trevor Whipple

bro i just call my dr and say ‘hey can u give me a diff one’ and they do it. no big deal. why is everyone making this so hard? also my friend’s cousin got her med back on formulary after sending a meme to her insurance company. it worked. trust me.

Alan Lin

For those navigating formulary transitions, I urge you to document everything: dates of calls, names of representatives, reference numbers, and copies of all correspondence. When filing an exception, ensure your provider includes clinical outcome data, duration of therapeutic stability, and documented adverse reactions to alternatives. The CMS appeals process is not punitive-it is procedural. If your request is denied, escalate immediately to your state’s insurance commissioner. Many states have patient assistance ombudsman programs that operate independently of insurers. And please, do not delay. The 30-day transition window is not a courtesy-it is a legal obligation under federal guidelines. Your health is not negotiable.

Scottie Baker

My wife’s cancer med got dropped last year. We had to beg, cry, and threaten to go on social media. They finally approved it after 21 days. She missed two treatments. Two. F-21. Days. And the insurance rep said ‘We’re sorry for your inconvenience.’ I almost threw my laptop through the window. This isn’t a system. It’s a war against sick people. And the worst part? They know they’re winning.