Prior Authorization Requirements for Medications Explained

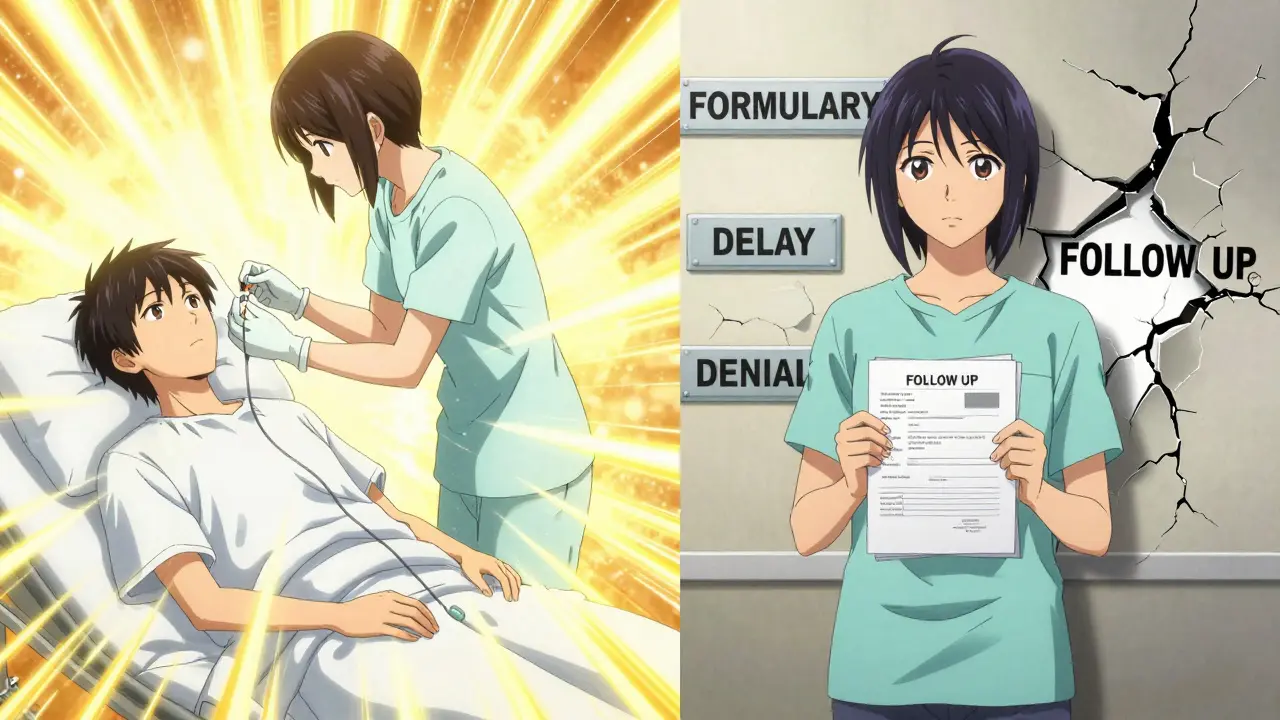

When your doctor prescribes a medication, you might expect to walk into the pharmacy and walk out with your pills. But if that medication requires prior authorization, you could be in for a delay - sometimes days or even weeks. This isn’t a glitch in the system. It’s a standard step built into most health insurance plans in the U.S. and other countries with managed care systems. Understanding how it works can save you time, money, and frustration.

What Is Prior Authorization?

Prior authorization (also called pre-authorization or prior auth) is a rule your health plan uses to decide if it will pay for certain medications. Before your insurance covers a drug, your doctor must submit paperwork proving it’s medically necessary. This isn’t about denying care - it’s about making sure you get the right drug at the right cost.Think of it like a gatekeeper. Not every medication gets automatic approval. Some are flagged because they’re expensive, have safer alternatives, or carry risks if used incorrectly. The goal? To avoid wasting money on drugs that aren’t needed - or that could be replaced by something cheaper and just as effective.

Which Medications Usually Require Prior Authorization?

Not all prescriptions need this step. But if your doctor prescribes one of these types, you’re likely to hit a wall at the pharmacy:- Brand-name drugs with generic versions available - If a generic version exists and works just as well, insurers will usually make you try it first.

- High-cost medications - Drugs that cost over $500 a month often require prior auth. Some cancer treatments or rare disease therapies can run thousands.

- Drugs with strict usage rules - For example, a medication might only be approved if you’ve tried and failed two other treatments first. Or it might be limited to patients with a specific diagnosis.

- Medications with dangerous interactions - If you’re already taking other drugs that could cause harmful side effects when mixed, your plan may require review.

- Drugs with abuse potential - Opioids, benzodiazepines, and some stimulants are tightly controlled. Insurers want to make sure they’re not being overprescribed.

- Off-label uses - If your doctor prescribes a drug for a condition it’s not officially approved for (like using a diabetes drug for weight loss), extra documentation is needed.

Medicare Part D plans use prior authorization too. They call it a “coverage determination.” The rules vary by plan, but the process is similar: your doctor must prove the drug is necessary for your condition.

How Does the Process Work?

The system isn’t designed to make things hard - but it often feels that way. Here’s how it usually plays out:- Your doctor decides you need a specific medication.

- Their office checks your insurance plan’s formulary (list of covered drugs). If prior auth is required, they start the request.

- Your doctor fills out a form - sometimes online, sometimes faxed - explaining why this drug is needed. They may include lab results, previous treatment failures, or specialist notes.

- The insurance company reviews the request. This can take 24 hours for urgent cases or up to 14 days for standard requests.

- You get a call or letter: approved, denied, or needs more info.

- If approved, the authorization lasts for a set time - often 6 to 12 months. After that, you’ll need to go through it again.

Some plans let you check the status online. Others only notify your doctor. That’s why it’s important to follow up. If you haven’t heard anything after five business days, call your doctor’s office. Ask: “Has the prior auth been submitted? Has it been approved?”

What Happens If It’s Denied?

A denial doesn’t mean you can’t get the drug. It just means the insurance company didn’t see enough proof yet. You have options:- Appeal the decision - Your doctor can file a formal appeal with more evidence. This usually takes 30 to 60 days.

- Try an alternative - Your insurer may suggest another drug on their formulary. Ask if it’s been tested for your condition.

- Pay out-of-pocket - If you can’t wait, you might pay cash for the medication and then submit a claim for reimbursement after approval. Some pharmacies offer discount programs for this.

- Request an emergency override - If you’re in danger without the drug (like a seizure disorder or heart failure), your doctor can mark the request as urgent. Approval can come in as little as 24 hours.

Medicare beneficiaries can also request a “fast track” review if their health is at risk. You can call your plan’s customer service number (found on your member card) to ask about expedited decisions.

What Can You Do as a Patient?

You’re not powerless in this process. Here’s how to stay in control:- Ask your doctor upfront - When a new prescription is written, ask: “Will this need prior authorization?”

- Check your plan’s formulary - Most insurers have a searchable list online. Look up the drug name. If it says “prior auth required,” you’ll know what’s coming.

- Use price-check tools - Many plans offer tools like “Price Check My Rx.” These show you not only coverage status but also cheaper alternatives.

- Don’t assume cash is cheaper - Sometimes, even without insurance, a drug costs less than the copay. Ask the pharmacy for the cash price.

- Keep records - Save every approval letter, denial notice, and call log. If you need to appeal, you’ll need proof.

Remember: your doctor’s office handles the paperwork - but you’re the one who has to follow up. If you don’t ask, no one else will.

Why Does This System Exist?

It’s easy to think prior authorization is just a bureaucratic hurdle. But there’s a real reason it’s in place.Insurance companies don’t cover drugs just because they’re prescribed. They cover them because they’re safe, effective, and cost-effective. For example, if a $3,000 monthly drug has a $50 generic alternative that works just as well, the plan wants you to try the cheaper one first. That saves money - and keeps premiums lower for everyone.

It also prevents dangerous prescribing. A drug that causes liver damage in people with certain conditions won’t be approved unless your doctor shows you’ve been tested and cleared.

And yes - it helps control costs. But experts agree: when done right, it improves care. The Academy of Managed Care Pharmacy says prior authorization ensures patients get “medication therapy that is safe, effective for their condition, and provides the greatest value.”

What About Emergencies?

If you’re having a medical emergency - like a heart attack, severe allergic reaction, or uncontrolled diabetes - prior authorization is not required. You get the medication you need immediately. Your insurance will cover it later, as long as it’s medically necessary.But if you’re not in an emergency, don’t assume you’re exempt. A “urgent” situation (like needing a refill on a chronic condition) still requires prior auth. Only true emergencies bypass the system.

Is This Process the Same Everywhere?

No. Prior authorization rules vary by insurer, state, and even pharmacy benefit manager (PBM). Medicare Part D plans have different formularies than private insurers like Cigna or Blue Shield. Some states have passed laws to limit how long the process can take. Others require insurers to approve requests within 24 hours for life-threatening conditions.In New Zealand, where the public health system is fully funded, prior authorization for medications is rare. But if you’re on a private health plan here - or if you’re traveling or living in the U.S. - this system will affect you.

Bottom line: if you’re on insurance, assume any new prescription might need prior auth. Always check.

What’s Changing?

There’s growing pressure to fix the system. Doctors say prior auth takes too long and eats up office hours. Patients say delays hurt their health. In 2023, the American Medical Association called it “a major source of frustration” and urged insurers to simplify the process.Some insurers are starting to use AI to auto-approve common requests. Others are reducing the number of drugs that require prior auth. But for now, the system remains complex - and you need to be prepared.

Does prior authorization mean my insurance doesn’t cover the drug?

No. It just means you need approval before coverage kicks in. The drug is still covered - but only after your doctor proves it’s medically necessary. Once approved, your insurance will pay according to your plan’s rules.

Can I get the medication while waiting for approval?

Yes, but you’ll pay full price. Some pharmacies let you pay upfront and then submit a claim later for reimbursement after approval. This can help if you can’t wait weeks. Ask your pharmacist about cash pricing and reimbursement options.

How long does prior authorization take?

It varies. Standard requests take 3 to 7 business days. Urgent requests - like if you’re at risk of hospitalization - can be approved in 24 hours. Always ask your doctor’s office if they marked it as urgent.

Why does my doctor have to do all the paperwork?

Because they’re the one who prescribed the drug and can best explain why it’s necessary. Insurance companies rely on clinical judgment, not patient requests. Your doctor must provide medical records, diagnosis codes, and sometimes lab results to support the request.

Can I switch to a different drug to avoid prior authorization?

Sometimes. Ask your doctor if there’s another drug on your plan’s formulary that works similarly. Many alternatives exist - especially generics. But don’t switch without consulting your doctor. Some drugs are not interchangeable, even if they treat the same condition.