Medicare Drug Coverage and Cost Assistance Options for 2025-2026

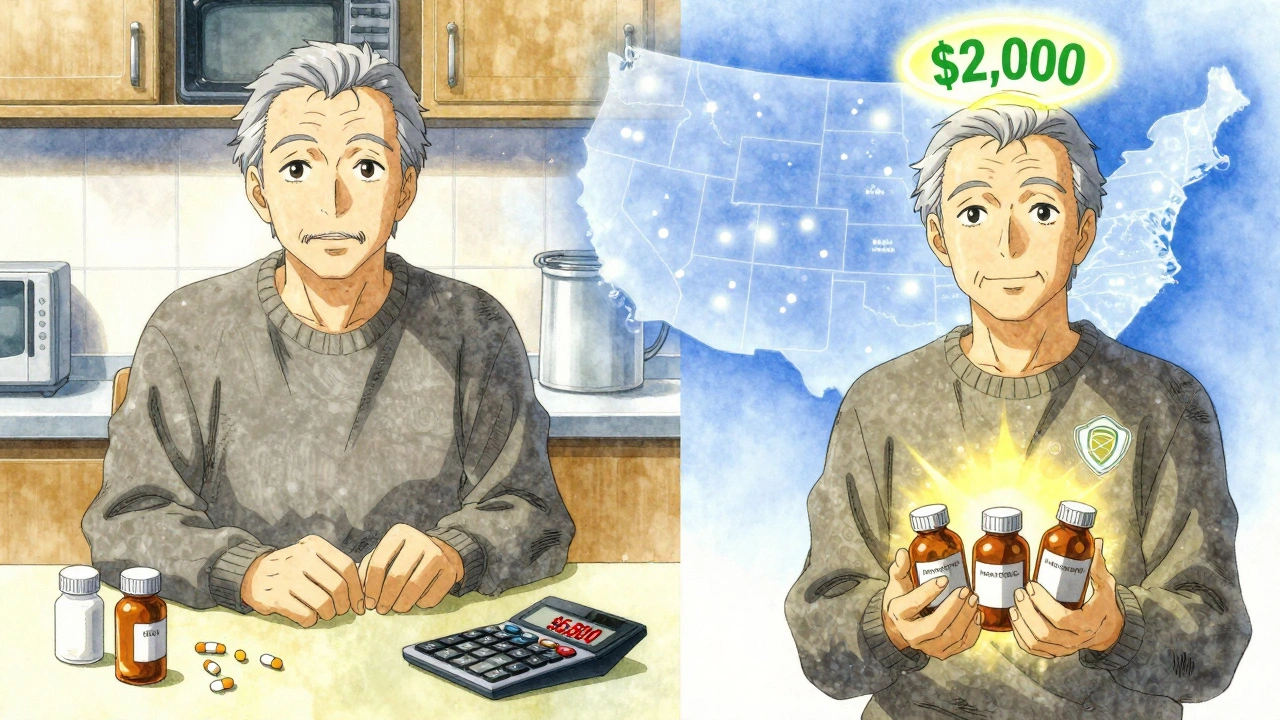

Starting in 2025, Medicare drug coverage changed in ways that could save you thousands of dollars a year-if you know how to use it. For millions of seniors on fixed incomes, the old system of the "donut hole" is gone. No more surprise bills after you hit a certain spending limit. Instead, there’s a hard cap: you’ll pay no more than $2,000 out of pocket for your prescription drugs in 2025. After that, your medications are free for the rest of the year. This isn’t a rumor. It’s the law, and it’s already in effect.

How Medicare Part D Works Now

Medicare Part D is the part of Medicare that covers prescription drugs. It’s not offered directly by the government. Instead, private companies like UnitedHealthcare, Humana, and CVS Health run the plans, but they must follow strict rules set by Medicare. In 2025, every Part D plan has the same basic structure: a deductible, an initial coverage phase, and catastrophic coverage.

First, you pay the deductible-up to $590 in 2025. Some plans have no deductible at all, but they usually charge higher monthly premiums. Once you’ve paid that, you enter the initial coverage phase. Here, you pay 25% of the cost for each prescription. The plan pays 65%, and the drug company kicks in 10%. That’s right-the manufacturer helps pay for your meds.

Here’s the big change: there’s no more coverage gap. In past years, once you spent a certain amount, you’d hit the "donut hole" and have to pay more out of pocket. That’s gone. Now, every dollar you spend on covered drugs counts toward your $2,000 limit. That includes your deductible, copays, and coinsurance. Premiums don’t count. Neither do drugs that aren’t on your plan’s list.

Once you hit $2,000, you’re done paying. For the rest of the year, you pay $0 for every covered medication. The plan pays 60%, the drug company pays 20%, and Medicare pays 20%. That’s it. No more bills. No more stress.

Who Gets the Biggest Savings?

This new system helps people who take multiple medications every day. If you’re on insulin, blood pressure pills, cholesterol meds, or cancer drugs, you’re likely to hit that $2,000 cap. For example, one diabetic in Florida told Medicare.gov she spent $6,800 on insulin and other drugs in 2024. In 2025, she’ll pay $2,000 at most. That’s more than $4,800 saved in one year.

Insulin is capped at $35 per 30-day supply, no matter what plan you’re on. That’s true for both Part B and Part D. If you’re on insulin, you’re already saving about $1,150 a year on average, according to AARP. That’s money you can use for groceries, utilities, or a doctor’s visit.

But if you only take one or two prescriptions a year, you might not reach the $2,000 cap. In that case, you could end up paying more in premiums than you save on drug costs. That’s why it’s not one-size-fits-all. You need to look at your own meds, your pharmacy, and your budget.

Extra Help: Free Assistance for Low-Income Seniors

If your income is low, you might qualify for Extra Help-a federal program that pays for your Part D premiums, deductibles, and copays. In 2025, you can qualify if you earn up to $22,590 a year as a single person or $30,660 as a couple. Even if you’re just below that, you might still get partial help.

Extra Help isn’t just a discount. It’s full coverage. If you get it, you’ll pay $0 for your deductible. Your copays will be $0 to $4.90 for generic drugs and $0 to $12.20 for brand-name drugs. And you’ll never pay more than $2,000-because you won’t have to. The program covers it all.

Most people don’t know they qualify. The Medicare Rights Center found that only 37% of eligible seniors applied for Extra Help in 2024. If you’re on Medicaid, SSI, or receive food stamps, you’re automatically enrolled. If not, you can apply online at SSA.gov or by calling 1-800-772-1213. It takes about 15 minutes. And if you’re approved, it applies retroactively to January 1.

Choosing the Right Plan in 2025

There are fewer choices than before. In 2024, the average Medicare beneficiary had 60 Part D plans to pick from. In 2025, that number dropped to 48. Stand-alone drug plans (PDPs) are shrinking fast. Only 14 are available on average, down from 21 last year. Most people are now signing up for Medicare Advantage plans that include drug coverage (MA-PDs), which now make up over half of all Part D enrollees.

But fewer plans doesn’t mean worse options. It means you need to be smarter. Don’t just renew your plan automatically. Eighty-three percent of people do-and most end up paying more. Your current plan might have dropped your pharmacy from its network. Or your insulin might now cost more. Or your premium went up by $20 a month.

Use the Medicare Plan Finder tool on Medicare.gov. Type in every drug you take, including dosage and frequency. Then enter your zip code and preferred pharmacy. The tool will show you the total annual cost for each plan: premium + drug costs. Pick the one with the lowest number. Don’t just look at the premium. A cheap plan with high drug costs can cost you more.

Also check your pharmacy’s network. If you go to CVS, Walgreens, or a local independent pharmacy, make sure they’re in-network. One man in Texas switched plans in 2025 and found his local pharmacy wasn’t covered. He had to drive 30 miles to get his meds-or pay full price.

What Counts Toward the $2,000 Cap?

Not everything you pay counts. Only these three things do:

- Your deductible

- Your copayments

- Your coinsurance

What doesn’t count?

- Your monthly premium

- Drugs not on your plan’s list

- Drugs you buy outside your plan’s network

- Over-the-counter medicines

That means if you pay $100 a month in premiums, that’s $1,200 a year that doesn’t help you reach your cap. You still have to pay $2,000 in out-of-pocket drug costs before you get free meds. So if you’re on a high-premium plan, you’re still on the hook for that $2,000.

When and How to Change Plans

You can only switch Part D plans during the Annual Enrollment Period: October 15 to December 7. That’s your only chance to change for the next year. If you miss it, you’re stuck until next fall.

But there are exceptions. If you get Extra Help, you can switch plans once a month. If you move to a new state or your plan drops your pharmacy, you can switch outside the enrollment period. If you’re in a Medicare Advantage plan and it stops offering drug coverage, you’ll automatically get a special enrollment period to pick a new plan.

Don’t wait until December to start. Start in October. Call your local SHIP (State Health Insurance Assistance Program). They’re free, local, and trained to help you compare plans. There are over 13,500 SHIP offices across the country. Find yours at shiptacenter.org.

What’s Coming in 2026

The $2,000 cap will rise to $2,100 in 2026. That’s because it’s adjusted for inflation. But the structure stays the same. The $35 insulin cap stays. Extra Help stays. The elimination of the donut hole stays. The big changes are done. Now it’s about using them right.

Medicare is also updating the Plan Finder tool in late 2025 to show you your total drug cost estimate before you enroll. That’s a big deal. Right now, you have to guess how much you’ll spend. Soon, you’ll be able to plug in your meds and see exactly how much each plan will cost you-down to the dollar.

Final Tips

- Don’t assume your plan is still the best one. Review it every year.

- If you take insulin, you’re already saving money. Make sure your plan covers it at $35.

- Apply for Extra Help-even if you think you don’t qualify. The income limits are higher than most people think.

- Use Medicare.gov’s Plan Finder. It’s free, official, and updated daily.

- Call your local SHIP. They’ve helped over 4 million people this year. They can help you too.

The old Medicare drug system was confusing, unpredictable, and expensive. The new one is simple, capped, and fair. You just have to take the time to understand it. And if you do, you could save thousands-without changing a thing about your meds.

Jennifer Patrician

So let me get this straight - the government suddenly gives a damn about seniors? Funny how this only happened after the midterms. You think Big Pharma didn’t lobby for this? They just rebranded the donut hole as a ‘cap’ so they could keep raking in cash while pretending to care. I’ve seen the contracts. This isn’t relief - it’s PR theater with a side of insulin price gouging disguised as kindness. Don’t believe the hype.

Mark Curry

It’s strange how we talk about money like it’s the only thing that matters. I mean, yes, $2,000 is a lot - but what about peace of mind? For years, people had to choose between eating and filling prescriptions. Now, at least, they don’t have to live in fear every time the pill bottle empties. Maybe the system isn’t perfect, but it’s less broken than before. That’s something.

Manish Shankar

Respectfully, I find this development profoundly encouraging. In my home country, elderly citizens often forgo essential medications due to cost, and the concept of a hard cap on out-of-pocket expenses is virtually unheard of. The structural clarity of the new Medicare Part D framework, coupled with the insulin pricing limit, reflects a commendable commitment to human dignity. I hope similar policies emerge globally.

luke newton

Oh please. You think this is about helping people? This is socialism by another name. They’re forcing drug companies to subsidize your meds because the government can’t manage its own budget. And now you want to hand out Extra Help like candy? Next thing you know, they’ll be paying your rent too. This isn’t compassion - it’s entitlement culture on a taxpayer-funded feeding frenzy.

Mark Ziegenbein

Let’s be real here - the entire narrative around this change is being weaponized by mainstream media to create the illusion of progress while quietly dismantling the private insurance market. The reduction from 60 to 48 plans isn’t simplification - it’s consolidation. And the Plan Finder tool? It’s designed to steer you toward MA-PDs because those are where the real profit margins are for UnitedHealth and Humana. You think you’re saving money? You’re just being funneled into a different cage with the same bars. And don’t get me started on how they redefined what counts toward the cap - premiums don’t count but your pharmacy’s markup does? That’s not transparency - that’s obfuscation dressed in policy-speak.

Marvin Gordon

This is actually huge. I’ve watched my mom stress over her meds for years. Last year she skipped doses just to make the insulin last. This year? She’s filling all her scripts. No guilt. No math. Just health. That’s worth more than any premium difference. Don’t overcomplicate it - if it helps real people, it’s worth it.

Juliet Morgan

just applied for extra help yesterday and got approved!! i thought i made too much but turns out i was way under the limit 😭 thank you to whoever wrote this post - i would’ve never known

Norene Fulwiler

I’m Nigerian-American and my mom just moved here last year. She was terrified of the healthcare system - thought she’d be charged $500 for a single pill. When I showed her the $35 insulin cap and the $2,000 limit, she cried. Not because she was sad - because for the first time, she felt like she belonged here. This isn’t just policy. It’s belonging.